1 Purpose

This procurement strategy enables the trust to improve its purchasing activity and meet both local and national priorities. This procurement strategy is to provide a framework for the delivery of an effective and efficient procurement service over the next three years, which recognises the ongoing challenges we face as a trust and the increasing demands on the NHS.

2 Scope and dimensions of non-pay spend

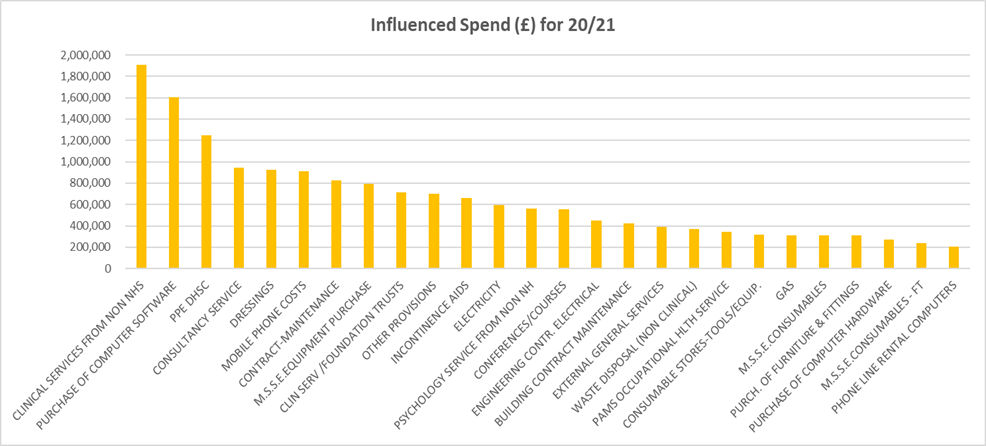

The total non-pay spend for RDaSH in 2020 to 2021 was £46.82m. Procurement influences the spending of £23.28m (49.7%) of the trusts resources. This includes procurements via purchase orders and non-purchase orders. The procurement department does not cover (influence) a spend of £23.54m (50.3%) which includes rent, rates, depreciation, travel, pension top-ups, drug expenditure and healthcare spend (for example, spend with other providers and technical adjustments).

2.1 List of influenced spend

A list of the top value non-pay items of expenditure can be found below in the appendix section.

The influenced spend can be further broken down by procurements that have a purchase order (60%), expenditure that has a contract in place (29%) and expenditure that is authorised by the invoice approval system (11%).

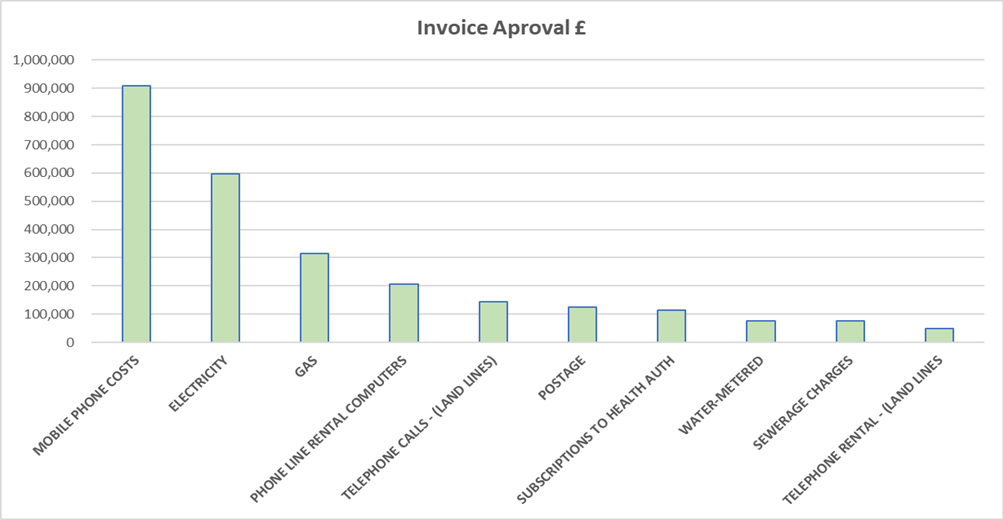

Invoice approval system expenditure mainly relates to energy and utilities for the trust.

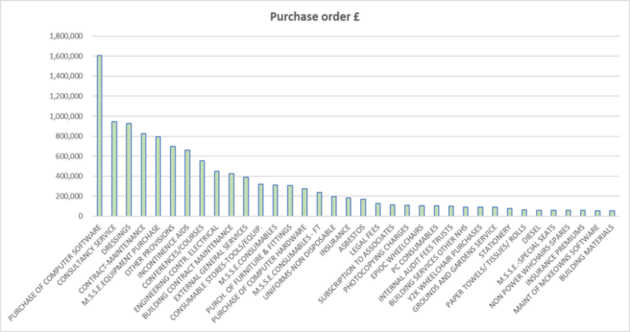

2.1.1 Purchase order spend

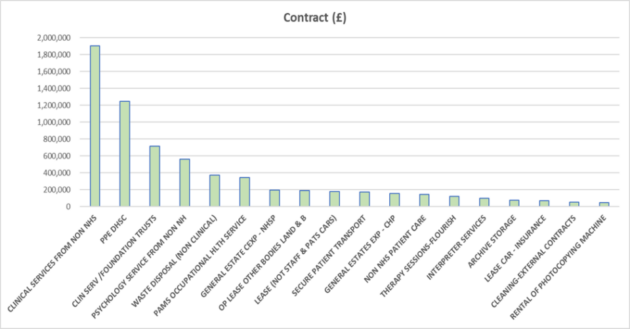

2.1.2 Contract spend

2.1.3 Invoice Approval spend

3.1 Efficiencies

Procurement will continue to monitor and review the National procurement landscape and ensure efficiency benefits are archived. This will include, working with NHS supply chain and utilising the category towers to ensure economies of scale are achieved by linking into their national contracts.

Action to be taken

- Look at the potential of stock control where consumables are stored, such as dressings.

- Review the potential of catalogues via the Integra Centros finance system.

- Work with care groups to review how goods and services are consumed, to offer support and advise on rationalisation and standardisation where appropriate.

- Implement a cross-functional non-pay expenditure group to explore further areas of high spend and reduce inefficiencies.

- Work in collaboration with South Yorkshire integrated care system (SY ICS) procurement teams to negotiate joint contracts and combining resources to ensure best value and rationalisation.

4 NHS standards in procurement

In 2018 the procurement department undertook and achieved NHS standards in procurement accreditation; this covers the following domains:

- strategy and organisation

- people and skills

- strategic procurement

- supply chain

- data systems and performance management

- policy and procedure

The standards are split into three levels with Level 1 being about procurement function, which is the level we have achieved. These standards have mainly been designed around acute hospitals and work had to be done with accreditors and assessors to adapt these to fit our type of trust and was a learning curve for all involved.

We will look to work towards achieving level 2 of this accreditation which focus is around the wider organisation and how procurement has influence across the trust over the next three years.

5 Trust green plan and carbon reduction

In line with the trust’s green plan, procurement will ensure social value and carbon reduction is built into all tender activity. This will not only cover supplies direct into the trust but will also ensure the supply chain is tracked and monitored. This is line with the SY ICS work detailed in sections 10.2 and 10.3.

6 Energy procurement

Procurement will work closely with the Estates team to ensure the national frameworks are utilised effectively and that the brokers utilised are managed effectively.

Action to be taken

- A report will be presented annually to FPIC to review energy usage review spend and costs, and agree any required contract changes.

7 Supplier management

To ensure we are utilising our suppliers to their full potential we must ensure we build firm relationships and set achievable and monitorable KPIs. These will be set at the tender stage where a baseline will be set, and the supplier must respond with a future plan on how they will achieve them, across the contract period.

Procurement will look to reduce the suppliers we utilise and where possible combine requirements to achieve economies of scale from one supplier. Also improving efficiency in supplier management by managing fewer suppliers.

Action to be taken

- Review the suppliers we are using, especially the top 5 and review their current performance and what we expect from them. We will look at bridging any gaps identified in negotiation with the supplier.

- Ensure key performance Indicators (KPIs) are incorporated in all tender activity and monitored accordingly, on a quarterly, six monthly or annual basis, depending on the type of goods or service being procured.

- Monitor the trust procurement work plan and review the procurement landscape and ensure this is considered within specifications to ensure efficiencies are realised. Looking at the broader picture in terms of not just our suppliers, but the supply chain they utilise also.

- Rationalise and standardise products that are being procured from various suppliers and market test to ensure just one or very few suppliers are utilised.

8 Standing financial instruction compliance and audit actions

From looking at procurement activities, procurement needs to promote the awareness around the trust’s standing financial instructions (SFIs) and standing orders. This needs to be addressed by raising understanding and promoting them in a way that is relatable and understandable. Also face to face discussion with care groups and corporate service areas will be undertaken to ensure full compliance and understanding.

Procurement will develop further and move away from purely transactional activity and work more towards stakeholder management and value-added activity, ensuring that users of the department are fully aware of why we have to follow process and that it is a quick and efficient process and no ‘red tape’.

Actions to be taken

- Encourage early engagement around procurement activity to ensure compliance, trust-wide.

- Attendance at regular care group or corporate meetings to promote the importance of SFIs and what the procurement function can do to help.

8.1 SQW reduction

During the period 2020 to 21 there was a total number of 260 single quote waivers (SQWs) raised for various departments and goods and services across the trust. These were raised under section 17 of the SFIs and are reported to the audit committee quarterly.

SQWs will continually be reviewed within procurement and where possible action taken to reduce these, by undertaking procurement exercises, utilising framework agreements and putting a robust contract in place.

Actions to be taken:

- Discuss with the board the possibility of raising the quote limit from £2,000 to £5,000.

- Meet and discuss with regular users of SQWs and what actions can be taken to reduce them, for example, market test by future forecasting or putting longer term contracts in place or ensuring whole life contracts are let including support and maintenance.

- Increase awareness trust-wide of the service procurement can provide to work with them to avoid the use of SQWs and the simple steps that can be taken to ensure a robust contract can be put in place.

8.2 Audit actions and counter fraud

To ensure past internal audit actions are reviewed and actioned proactively, monthly reviews will continue to be undertaken to:

- relevant non-pay expenditure is being influenced by procurement

- contracts are in place for relevant procurements and placed on the contract database

- areas of concern to be discussed with care group and corporate services, where regular use of SQWs and reactive purchasing practices are identified

- ensure that separation of duties and general audit practices are maintained, and that due diligence is undertaken on suppliers, before use

- when using framework agreements, that mini competitions are undertaken and where not possible, and a direct award is necessary that this is justified and signed of within the procurement department

- ensure all procurement staff are familiar with audit recommendations and their responsibilities surrounding them. Also that training is maintained around counter fraud and how to spot unlawful action

9 E-procurement

9.1 Integra Centos

To ensure the new Integra Centros is implemented and embedded effectively. This will include not only finance but will have an impact trust-wide for requisitioners and authorisers. A roll-out plan will be devised, which will include both group and if necessary one to one training for users.

9.2 Atamis

The trust will join with other trusts within our procurement ICS, to use the Atamis E-tendering system, this is a vast improvement on the system currently used and has improved functionality to undertake the following:

- improved visibility of our advertised opportunity to a broader supplier base

- ability to design pre-qualification questionnaires within the system

- evaluation tool, to avoid the emailing of bids around evaluation panels

- improved auditability

- visibility of tenders issued throughout the ICS and beyond

- access to a suite of tender documents and templates, for example, terms and conditions

- contracts database which can be manged within the system rather than on an Excel spreadsheet

- ability to manage SQWS

10 ICS work and collaboration

We will continue our valuable work with the SYB ICS procurement team which is working towards shared values across member trusts.

This is to involve sharing of our contracts database which is then fed into a master work plan, and is reviewed to access joint and collaborative market testing. We are also looking at shared tender templates and knowledge sharing on various projects.

10.1 Procurement target operating model

The work undertaken by SYB ICS procurement team is lead by the procurement target operating model (PTOM). This is made up of seven dimensions of change which each trust has taken responsibility to lead on behalf of the ICS, see fig 1. There are 34 recommendations within this model, 7 of which belong to sustainability.

10.2 Sustainability

RDaSH has taken the lead on the sustainability dimension. This is detailed at fig 2. This dimension has 7 recommendations, 2 of which have already been completed. Of the five remaining, the following actions will be taken:

[TABLE]

The work undertaken around this dimension will become embedded within the trusts green plan.

10.3 Social value

A key element of the sustainability dimension is social value. This is from the Public Services (Social Value) Act 2012. From a procurement perspective this asks organisations to consider social value ahead of procuring services that have to be advertised on the UK e-notification service. To comply with this act, the trust must consider the following 3 elements:

10.3.1 Economic

- Employment, training and work experience opportunities for local people.

10.3.2 Environmental

- Local staff, local suppliers and local work reducing the carbon footprint.

10.3.3 Social

- Supporting local community initiatives, for example, charities, local amateur sports teams etc.

Social value must therefore look beyond the cost of the contract but look at the social impact. From a recent update in procurement policy, there has become need to ensure on service contracts that 10% of the evaluation criteria be dedicated to social value.

A suite of evaluation questions, relating to this subject has been devised and will be utilised to ensure these criteria are mandated.

10.3.4 Action to be taken

- Ensure all teams involved in procurement tender activity are trained effectively to evaluate these criteria.

- Develop working relationships with other local government to devise joint policies and share working practice, such as DMBC and RMBC.

- Develop better working relationships with local suppliers and SMEs to drive the local economy.

- Ensure that net zero plans are obtained from suppliers at tender stage over the £40,000.00 tender limit.

11 New EU procurement regulations

With the event of Brexit there is to be a change on the EU procurement regulations. A green paper went to the government in March 2021 and a decision on the way forward is being agreed. The government are proposing embedding the following principles:

- public good

- value for money

- transparency

- integrity

- fair treatment of suppliers

- non-discrimination

Guidance on these principles has not yet been released it has been delayed, but Procurement will ensure these are utilised and interpreted to ensure compliance with the new regulations.

12 Improve purchasing profile

Although good relationships currently exist between procurement and the care groups and corporate services, there are further opportunities to improve. To help influence key stakeholders with their procurement activity, achieving savings and mitigating risk, the procurement function should be proactively promoting the work we do and how we can help by ensuring all national and local sourcing options are covered.

Encouragement of early engagement so we can ensure opportunities are realised and what the supply market looks like and analyse information on the current contract so we can possibly approach this in a different way

12.1 Staff development

The team within procurement are the best asset that we have and developing their knowledge, expertise and experience through training and development is the best way to ensure that that Procurement can help the trust achieve value for money.

The procurement team will continue to participate in procurement skills development training and will be encouraged to undertake their chartered Institute of purchasing and supply (CIPS) qualifications. Various secondment opportunities arise via the procurement ICS which staff are encouraged to consider where appropriate.

12.1.1 Recommendations

FPIC is asked to:

- Note the progress and issues that have been raised in this Procurement strategy.

Lynne Beedle, Head of Procurement, April 2022

13 Appendices

13.1 Appendix A Top 50 items of influenced spend

| Item | Total spend |

|---|---|

| Clinical services from non NHS | 1,904,267 |

| Purchase of computer software | 1,604,684 |

| PPE DHSC | 1,244,977 |

| Consultancy service | 942,930 |

| Dressings | 924,972 |

| Mobile phone costs | 909,436 |

| Contract maintenance | 824,291 |

| MSSE equipment purchase | 795,144 |

| Clinical service or foundation trusts | 715,101 |

| Other provisions | 698,513 |

| Incontinence aids | 660,853 |

| Electricity | 596,481 |

| Psychology service from non NHS | 562,102 |

| Conferences or courses | 556,524 |

| Engineering contract electrical | 448,535 |

| Building contract maintenance | 426,643 |

| External general services | 387,722 |

| Waste disposal (non-clinical) | 373,558 |

| PAMS occupational health service | 341,887 |

| Consumable stores-tools or equip | 319,591 |

| GAS | 313,787 |

| MSSE consumables | 312,721 |

| Purchase of furniture and fittings | 308,436 |

| Purchase of computer hardware | 273,546 |

| MSSE Consumables, FT | 240,208 |

| Phone line rental computers | 206,188 |

| Uniforms-non disposable | 196,989 |

| General estate CEXP, NHSP | 192,096 |

| OP leases other bodies land and B | 189,595 |

| Insurance | 185,131 |

| Lease (not staff and pats cars) | 179,840 |

| Secure patient transport | 169,247 |

| Asbestos | 168,850 |

| General estates EXP, CHP | 156,632 |

| Phone calls (landlines) | 144,477 |

| Non NHS patient care | 142,725 |

| Legal fees | 130,128 |

| Postage | 124,024 |

| Therapy sessions-flourish | 121,962 |

| Subscriptions to health auth | 114,974 |

| Subscription to associates | 112,249 |

| Photocopying charges | 110,811 |

| EPIOC wheelchairs | 106,668 |

| PC consumables | 104,977 |

| Interpreter services | 99,260 |

| Internal audit fees trusts | 98,588 |

| Building services other NHS | 93,000 |

| Y2K wheelchair purchases | 90,872 |

| Grounds and gardens service | 90,537 |

| Stationery | 77,201 |

| Water-metered | 74,820 |

| Sewerage charges | 74,593 |

13.2 Appendix B Top 50 items of purchase order spend

| Item | Total spend (£) |

|---|---|

| Purchase of computer software | 1,604,684 |

| Consultancy service | 942,930 |

| Dressings | 924,972 |

| Contract maintenance | 824,291 |

| MSSE equipment purchase | 795,144 |

| Other provisions | 698,513 |

| Incontinence aids | 660,853 |

| Conferences or courses | 556,524 |

| Engineering contr. electrical | 448,535 |

| Building contract maintenance | 426,643 |

| External general services | 387,722 |

| Consumable stores-tools or equip | 319,591 |

| MSSE consumables | 312,721 |

| Purchase of furniture and fittings | 308,436 |

| Purchase of computer hardware | 273,546 |

| MSSE consumables, FT | 240,208 |

| Uniforms-non disposable | 196,989 |

| Insurance | 185,131 |

| Asbestos | 168,850 |

| Legal fees | 130,128 |

| Subscription to associates | 112,249 |

| Photocopying charges | 110,811 |

| EPIOC wheelchairs | 106,668 |

| PC consumables | 104,977 |

| Internal audit fees trusts | 98,588 |

| Building services other NHS | 93,000 |

| Y2K wheelchair purchases | 90,872 |

| Grounds and gardens service | 90,537 |

| Stationery | 77,201 |

| Paper towels or tissues or rolls | 63,958 |

| Diesel | 60,908 |

| MSSE special seats | 60,633 |

| Non-power wheelchairs spares | 58,379 |

| Insurance premiums | 57,077 |

| Maintenance of McKeown’s software | 56,497 |

| Building materials | 55,630 |

| Maintenance of computer software | 54,569 |

| Cleaning equipment, electrical | 50,060 |

| Provisions DCF | 49,878 |

| Courses or training by FTS | 49,333 |

| M and SSE maintenance other repairs | 47,698 |

| Property insurance | 47,603 |

| Advocacy | 47,049 |

| Reference books | 46,277 |

| Other advertising | 45,542 |

| Public relations | 44,189 |

| Laundry materials | 41,332 |

| Security systems | 40,790 |

| Wheelchair spares opening bal | 39,299 |

13.3 Appendix C Top contract spend

| Item | Contract spend (£) |

|---|---|

| Clinical services from non NHS | 1,904,267 |

| PPE DHSC | 1,244,977 |

| Clinical service or foundation trusts | 715,101 |

| Psychology service from non NHS | 562,102 |

| Waste disposal (non-clinical) | 373,558 |

| PAMS occupational health service | 341,887 |

| General estate CEXP, NHSP | 192,096 |

| OP leases other bodies land and B | 189,595 |

| Lease (not staff and pats cars) | 179,840 |

| Secure patient transport | 169,247 |

| General estates EXP, CHP | 156,632 |

| Non NHS patient care | 142,725 |

| Therapy sessions-flourish | 121,962 |

| Interpreter services | 99,260 |

| Archive storage | 72,496 |

| Lease car, insurance | 70,678 |

| Cleaning external contracts | 53,113 |

| Rental of photocopying machine | 43,389 |

13.4 Appendix D Top invoice approval spend

| Item | Invoice approval spend (£) |

|---|---|

| Mobile phone costs | 909,436 |

| Electricity | 596,481 |

| Gas | 313,787 |

| Phone line rental computers | 206,188 |

| Phone calls (landlines) | 144,477 |

| Postage | 124,024 |

| Subscriptions to health authority | 114,974 |

| Water-metered | 74,820 |

| Sewerage charges | 74,593 |

| Phone rental (landlines) | 47,840 |

Page last reviewed: December 16, 2024

Next review due: December 16, 2025

Problem with this page?

Please tell us about any problems you have found with this web page.

Report a problem